Payment Plans

Hawai'i Pacific University allows students and families the flexibility to spread their cost into manageable monthly installment payments through our partnership with Transact.

- Payment Plans enable you to spread your cost for tuition, fees, housing, meal plans, and other billed charges into monthly payments spread across the semeter

- If you and your family can afford to pay your tuition during the semester in installments, you can avoid higher interest rates charged by loan servicers

- It's simple to enroll - sign up within the Payment Portal

- You can sign up for AutoPay to conveniently schedule payments online - set it and forget it!

- By enrolling in a Payment Plan, your account remains in good standing without you having to pay the entire balance due by the Tuition Payment Deadline

- Your account is considered to be in good standing if paid in full by the Tuition Payment Deadline or you are enrolled in a Payment Plan before this date, with all payment plan payments made on time and the payment plan balance being equal to the total amount you owe.

Enroll before the deadlines shown below. Your enrollment date determines the length of your payment plan (how many months your plan will be) and the amount (your total amount owed divided by the number of payments you will make).

To set up a payment plan:

STUDENTS: log into the myHPU portal, then click on the "Business & Payments" icon to enter the payment portal.

aUTHORIZED USERS/PAYERS: First, ensure your student has set you up as a Payer (Authorized User). Find out more here. Once that step is complete, begin by logging into the Payment Portal using your credentials at https://myebill.hpu.edu.

Follow the prompts, starting as shown in the the below image, to enroll in a plan. Read all terms and conditions, sign all required disclosures, and complete enrollment by paying the enrollment fee.

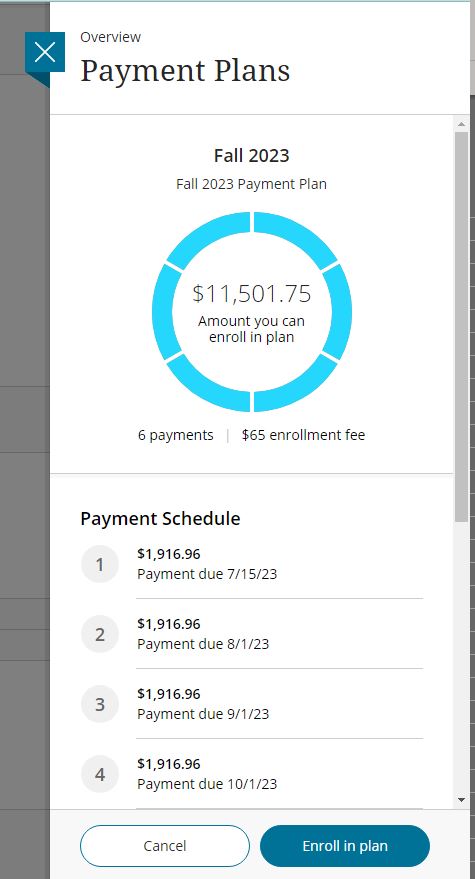

When you begin enrolling in a plan, you will see an image such as the below example outlining the payment schedule and amounts. Click on "Enroll in Plan" and complete the remaining steps as prompted to complete your enrollment.

Enrollment DEADLINES

|

6 Month Plan |

5 MONTH PLAN |

4 Month Plan |

3 Month Plan |

2 Month Plan |

|

Enrollment opens the first week of July, after charges post and you have received your first eBill Statement last day to enroll: July 14th Payments will be due:

|

Enroll beginning July 15th.

LAST DAY TO ENROLL: JULY 31ST Payments will be due:

|

Enroll beginning August 1st.

LAST DAY TO ENROLL: August 31ST Payments will be due:

|

Enroll beginning Sept 1st.

LAST DAY TO ENROLL: September 30Th Payments will be due:

|

Not available.

|

|

6 Month Plan |

5 MONTH PLAN |

4 Month Plan |

3 Month Plan |

2 Month Plan |

|

Enrollment opens November 12th, after charges post and after you have received your first eBill Statement. LAST DAY TO ENROLL: December 14th Payments will be due:

|

Enroll beginning Dec 15th.

LAST DAY TO ENROLL: december 31ST Payments will be due:

|

Enroll beginning January 1st.

LAST DAY TO ENROLL: JANUARY 31ST Payments will be due:

|

Enroll beginning Feb 1st.

LAST DAY TO ENROLL: FEBRUARY 28TH * Payments will be due:

*February 28th is the last day to enroll, even if it is a leap year and February 29th is the last day of the month. |

Not available.

|

|

6 Month Plan |

5 MONTH PLAN |

4 Month Plan |

3 Month Plan |

2 Month Plan |

|

Not available. |

Not available. |

Enrollment opens the first week of April, after charges post and you have received your first eBill Statement. last day to enroll: april 30th Payments will be due:

|

Enroll beginning May 1st.

last day to enroll: MAY 31ST Payments will be due:

|

Enroll beginning June 1st.

last day to enroll: JUNE 30TH Payments will be due:

|

Frequently Asked Questions

Non-refundable enrollment fee paid to Transact for each semester a payment plan is selected:

- $35 for a Summer semester payment plan

- $65 for a Fall or Spring semester payment plan

Depending on your payment method used, additional fees may apply. Online payments are free when you select eCheck/ACH directly from your bank account. Debit/credit card payments incur additional processing fees. Find out more about processing fees and payment options by visiting hpu.edu/pay.

If your payment is returned as nonpayable for any reason, your account will incur nonrefundable returned item fees:

- Returned item fee paid to Transact - $25 per returned item

- Returned item fee paid to HPU - $30 per returned item

If your payment is late, you will owe transact payment plan late fees:

- Late Fees paid to Transact - $10/month (there is a grace period of 14 days)

Contact Transact's Payment Support team.

Transact representatives are available at (800) 339-8131 Monday - Friday 8:00 AM - 9:00 PM ET (2:00 AM - 3:00 PM HST).

HPU offers a special payment plan students who live on-campus and receive Post 9/11 GI Bill® benefits. The plan will match the disbursement dates for housing stipends which will allow student and benefactors to make payments as they themselves are being reimbursed.

How to qualify: If your on-campus housing charges reflect in your payment portal at MyHPU, Business & Payments and you have already certified your enrollment with HPU’s VA Center, you’re already qualified. You can confirm both of these items are satisfied by logging in to MyHPU, Business & Payments.

If one or the other (housing or VA certification) is missing, please reach out to studentaccounts@hpu.edu for assistance. Make sure to include your student ID number in the body of your email.

Enrollment dates for these plans are shown in this table:

|

4 Month Plan |

3 Month Plan |

2 Month Plan |

|

|---|---|---|---|

Fall |

Enrollment opens August 21st. Enrollment closes October 14th. Payment due dates:

|

Enrollment opens October 15th. Enrollment closes November 14th. Payment due dates:

|

Not available. |

Spring |

Enrollment opens January 21st. Enrollment closes February 14th. Payment due dates:

|

Enrollment opens February 15th. Enrollment closes March 14th. Payment due dates:

|

Not available. |

Summer |

Enrollment opens May 21st. Enrollment closes June 14th. Payment due dates:

|

Enrollment opens June 15th. Enrollment closes July 14th. Payment due dates:

|

Enrollment opens July 15th. Enrollment closes August 14th. Payment due dates:

|

No, HPU does not offer payment plans or financial aid for Winter terms.

Please visit hpu.edu/pay to find out more about payment options.

To make a payment towards your account balance rather than your payment plan for a particular term, log in to your myHPU portal, then select the "Business & Payments" icon in the Student QuickLaunch section. Once you are in the payment portal, on the left menu, select Make a Payment. If the current term is not listed as something that can be paid, click on the option to Pay your Past Due Charges. Enter the amount you would like to pay and select the relevant term.

If you did not sign up for a payment plan by the deadlines shown on this page, you have missed the window to enroll in a standard payment plan for the semester, and your account is likely past-due and subject to financial consequences.

Pay your account balance in full to avoid further penalties and consequences of nonpayment.

Under certain limited circumstances, HPU may authorize enrollment in a past-due payment plan. Please contact us to discuss your options. Not all students will qualify for a past-due payment plan. Payment plans are not permitted to continue into future semesters of enrollment at HPU.

If your account balance for the term decreases after you signed up for your payment plan, your plan will automatically adjust for lower payments the next time you log in to the payment portal.

If your account balance for the term increases after you signed up for your payment plan, the next time you log in to your payment portal, the system will request your permission to increase your payments to cover your entire balance outstanding for the term. This is called "payment plan consolidation." IF YOU DO NOT ACCEPT THE PLAN CONSOLIDATION, YOU STILL OWE THE INCREASED AMOUNT TO HPU AND NEED TO MAKE ARRANGEMENTS TO PAY THAT AMOUNT IN FULL IMMEDIATELY. Your account is not in good standing if you do not accept the plan increase, and you may be subject to financial consequences.

Question: The Tuition Payment Deadline requires that students pay in full or sign up for a payment plan before the semester begins. What if I need a payment plan to afford my expected amount owed, but all aid has not yet been posted and the payment plan payment is too high?

In most cases, if a student and/or their family has processed all required documents in a timely manner, then financial aid, loan, scholarship, tuition assistance, and other amounts will already be reflected in your balance by the Tuition Payment Deadline, and this will not be an issue.

However, there could be a delay in processing documents during high volume times, or it may be that the student did not submit the required documentation in time to meet the deadline. In that case, the student/family may not be able to pay the full expected amount owed, and the payment plan amount may be more than the student or family can afford to pay. What should the student/family do in that case?

Answer: It's okay to sign up for a payment plan even if all credits have not yet posted. Once the payment plan sees the aid posted, the payment plan will automatically reduce the balance on your payment plan and will reduce all remaining installment payments to a lower amount.

- If the first payment without the credits posted is too large for your budget and you anticipate needing a payment plan this semester, in order to meet the requirements of the Tuition Payment Deadline, it would be adviseable to sign up for a payment plan by that date regardless. This allows you to achieve the smallest monthly payment possible, because once the aid has posted, the remaining payments will reduce automatically. If you wait, you might miss the enrollment period for the 6, 5, or 4-month plan and your remaining payments will be a larger amount. Also, if you have not paid your expected amount owed in full and you have not signed up for a payment plan by the Tuition Payment Deadline, your account begins to be considered past due. Your account will be considered in good standing even though it is not paid in full as it will be accounted for in a payment plan.

- If the first payment without the credits posted is too large, remember that there is a grace period of 14 days after the payment plan payment due date before payment plan late fees of $10/month begin to be assessed. This means you have an additional 14 days past the payment due date for the expected financial aid to be fully processed and posted to your account, reducing your installment payment amounts.

- If you choose to enroll in a payment plan while you await finalization of your financial aid, ensure you have done everything necessary to have the aid finalized and posted to your account as soon as possible.

- EXAMPLE: A student's account balance is $12,000. The student is expecting an $8,000 loan to post, but those loans are not yet finalized or posted to the student account. Signing up for a 4-month plan in August before the loans are applied means that a $3,000 payment will be due September 1st. This payment is too big for the student to pay; they cannot afford this amount. However, the student can wait as long as September 14th to pay before a $10 late fee is applied. So, if the loans are fully processed as late as September 13th, the payment plan will automatically adjust the payment due down to $1,000, and the student can pay the lower $1,000 amount instead of $3,000 as their first payment on September 13th without incurring a $10.00 late fee. Their next payment of $1,000 will be due as scheduled on October 1st.

IMPORTANT: HPU payment plans automatically reduce when balances go down, but do not automatically increase when charges increase (in order to protect students from unexpected automatic withdrawals). Students must accept payment plan increases in the payment portal if their payment plan balance is less than their actual semester balance for any reason.